It seems highly probable that somebody asked Santa Claus about high speed and cheap maintaining in the sphere of decentralized finance. That is why we got these three laconic letters – AMM– as a gift. An AMM (stands for an Automated Market Maker) is the main driving force of DeFi. It allows everyone to create market and then trade cryptocurrency in a very safe and decentralized way. An Automated Market Maker enables immediate deal transactions and regulates asset prices in liquidity pools automatically. After analyzing this article, we will find out if an AMM is able to compete with classic order book exchanges. So, here we go!

Introduction / Is AMM popular?

Is decentralized finance (DeFi) staying on top nowadays? Let’s begin with the fact that even such a platform as Ethereum has paid attention to DeFi, not to mention smaller contract platforms. Additionally, everybody is aware of yield farming that is known as a marvelous way of token distribution. In this regard, flash loans are at their popularity peak nowadays. An Automated Market Maker protocols constantly experience a greater number of users and a rising liquidity. DeFi sphere is extremely large and it is necessary to answer some basic questions concerning it.

What Is an Automated Market Maker (AMM)? / What is AMM? Hmm…Let’s find out!

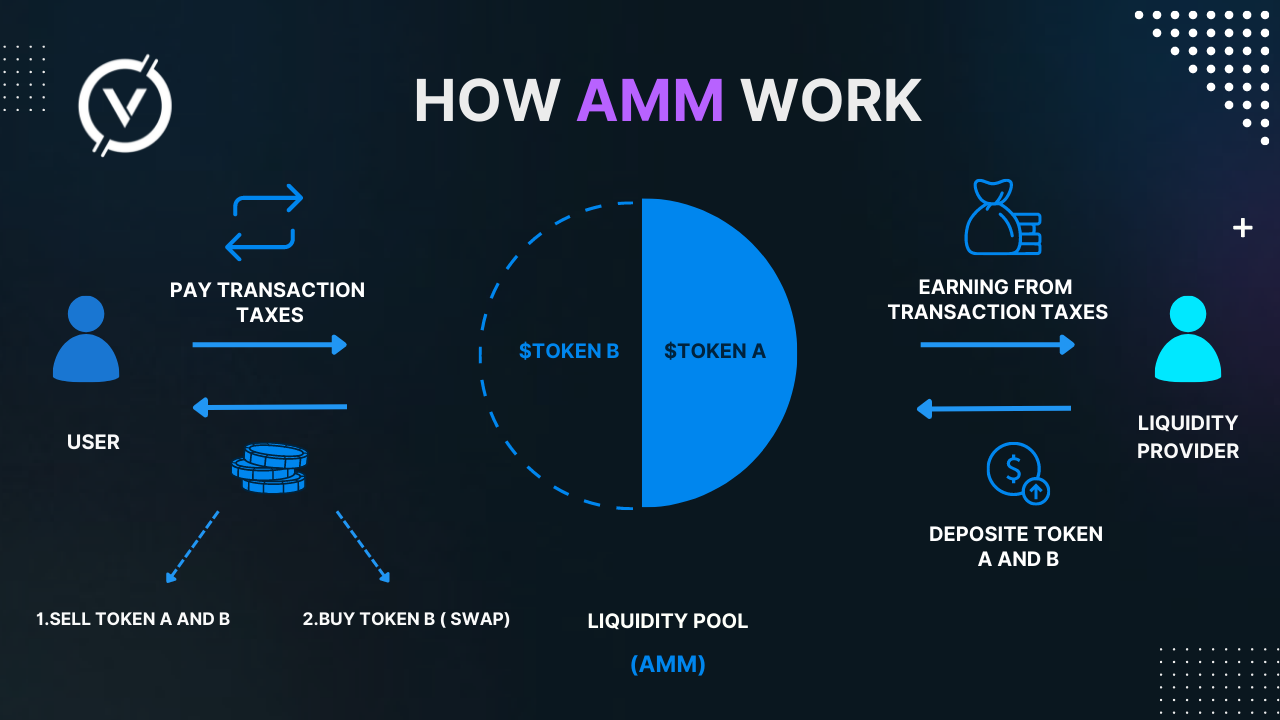

An AMM is a program algorithm that makes an immediate digital trade possible. Being a part of DeFi, an Automated Market Marker gets rid of ordinary buyers and sellers. It replaces them with using liquidity pools. Liquidity pools are token pools blocked in smart contracts and used for market creation. DeFi relies on an AMM or smart contracts. It means that users don’t deal with other traders but with smart contracts. Consequently, there is no necessity in order books as before. The process of giving liquidity to exchanges is called market making and an organization that provides this service is named market maker.

The main aim of an AMM is to make finance markets more effective and decrease price volatility (the financial indicator showing price changeability for something) for assets. Algorithmic trading helps to reduce parent order cost and any risk of its fulfilling. There is a great variety of formulas for asset pricing, but they are combined by the fact that they are done algorithmically. In such a way, everyone can become a market maker and obtain passive income with the help of it.

How does an Automated Market Maker work?/AMM also has to work. But how?

The most significant point is that an AMM works on the basis of a smart-contract. A smart-contract is kept on the blockchain and contains some agreements and promises that are specified not in a usual but digital way.

The advantage of an AMM is that it is decentralized and there is no necessity in another trader in order to make a trade. A smart-contract helps to make a market for everyone. For sure, it reminds an order book exchange in this way but passes in more convenient and efficient manner.

It should be noticed that trades occur between wallets of users. In other words it will be P2P (peer-to-peer) transactions. For instance, if one person sells, another person buys BNB. It is really an interesting find. It is formulas that define what exact price a person gets for an asset during buying or selling.

As we see, there is no necessity in counterparties. That is cool. Nevertheless, the market must be created. What do we do next? Right. The liquidity in the smart contract still has to be given by users named a liquidity provider.

What is a liquidity pool? / Let’s dive into a liquidity pool!

Firstly, let’s define the notion ‘liquidity’. It is how easily an asset can be converted into another asset (more often a fiat currency). The main point of such a conversion is not affecting asset market price. In the earliest day of an AMM, decentralized exchanges miss liquidity. There were not many people wishing to trade in these conditions.

An AMM helps to overcome mentioned difficulties by creating a liquidity pool and making liquidity providers possible. In order to have more liquidity, the pool should have more assets. In this way, it turns into easier trading on DeFi. An AMM supposes that we avoid trading between buyers and sellers, and support trading against a pool of tokens or a liquidity pool in other words. Moreover, every liquidity pool is a shared pot of tokens. We can provide a liquidity pool with tokens and the price of the tokens in these pools will be determined by various mathematical formulas. These formulas can be changed and used for different purposes.

Have you heard any good news recently? If no, read it here, please: any person having an internet connection and any kind of tokens can become a liquidity provider after supplying tokens to a liquidity pool. Liquidity providers usually get a fee for providing tokens to pools. The fee is given by a trader who deals with a liquidity pool. What is more, liquidity providers are able to earn yield in the form of project tokens. Hooray! Here comes yield farming!

How to add liquidity and earn on Venera Swap

- Step 1. Go to the liquidity page on Venera Swap app.

- Step 2. Follow the instructions in the video below

What is impermanent loss? / Impermanent loss happens

‘You must know your enemy to win’, says the proverb. What about such an enemy as a loss? Impermanent loss, in our case.

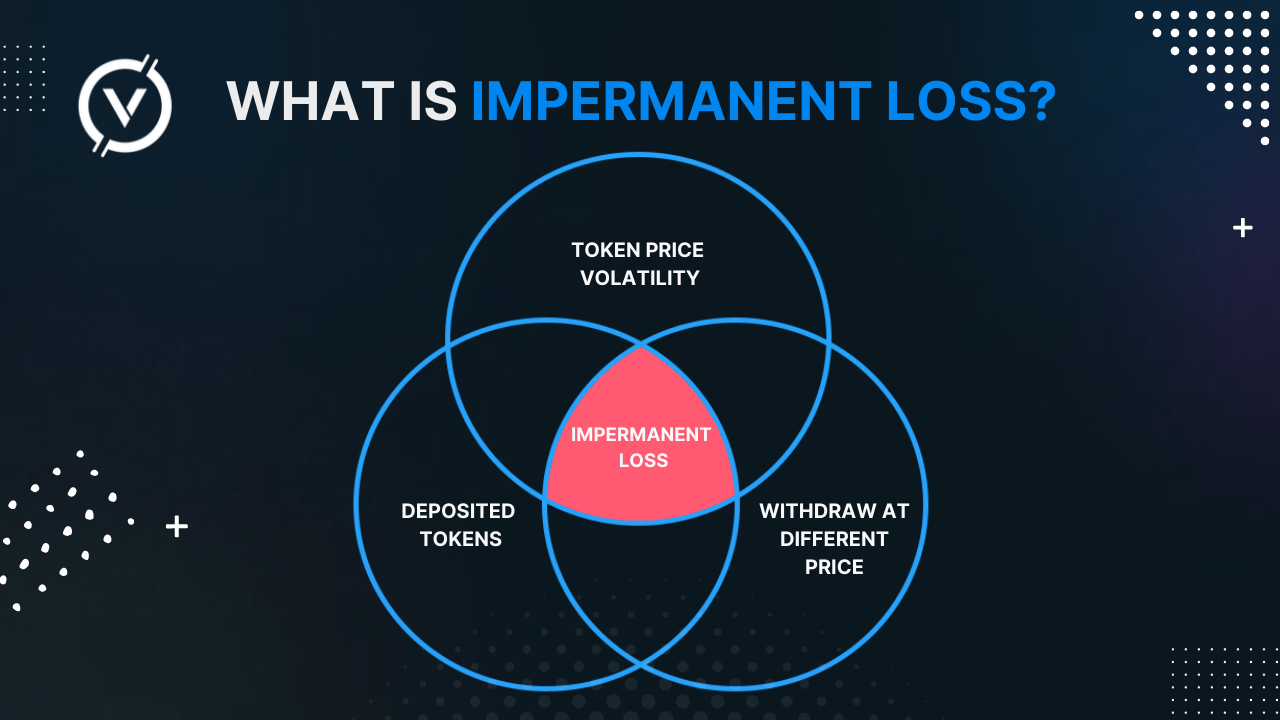

Impermanent loss is a situation where the price ratio of deposited tokens rotates after their deposition in the pool. The fact that the bigger the rotation is, the bigger the impermanent loss, darkens the situation. In view of the situation, an Automated Market Maker will work better with token pairs that have not different values. For instance, it can be wrapped tokens or stablecoins. If the price ratio between the pair is in a very small extent, impermanent loss is insignificant, fortunately.

Moreover, if we withdraw our funds at a different price ratio than when we deposited the funds, the losses are undoubtedly constant. On the one hand, the trading fees can weaken a loss; on the other hand, we should always consider the risks. In any case, as we deposit funds into an AMM, we should realize the implications of impermanent loss.

Closing thoughts / To be continued…

The world is changing nowadays. Both good and bad happen day by day. But nothing remains unchanged. In the world of DeFi an Automated Market Maker is becoming a must-have. It helps us to create our own markets in a most efficient and comfortable way. Why speaking about limitations? Why speaking about order books exchanges? We have faced up with an outstanding innovation represented by an AMM and there is no way to avoid it.

Well, please, keep in mind that only few companies give modern solutions in the AMM world. Let’s not waste our time and develop this niche as quickly and hard as possible. Let’s be ahead of the rest!