It happens that sometimes cryptocurrency is removed from circulation. This process is called ‘coin burn’. It should be mentioned that the total supply will be decreased. Let’s take the Binance Coin in order to show the following situation in detail.

There was a period when the Binance Coin was part of Ethereum. Additionally, Binance did constant Coin Burn steps using a smart contract function. The function is named ‘burn function’. The BNB burning events happen every quarter until 100,000,000 BNB are destroyed at last.

How to understand which amount of BNB coins must be burnt? It is calculated due to the number of trades on the exchange within the period of three months. The most significant aim of this process is the creation of a deflationary effect. When the number of tokens is reduced, the cryptocurrency valuation increases.

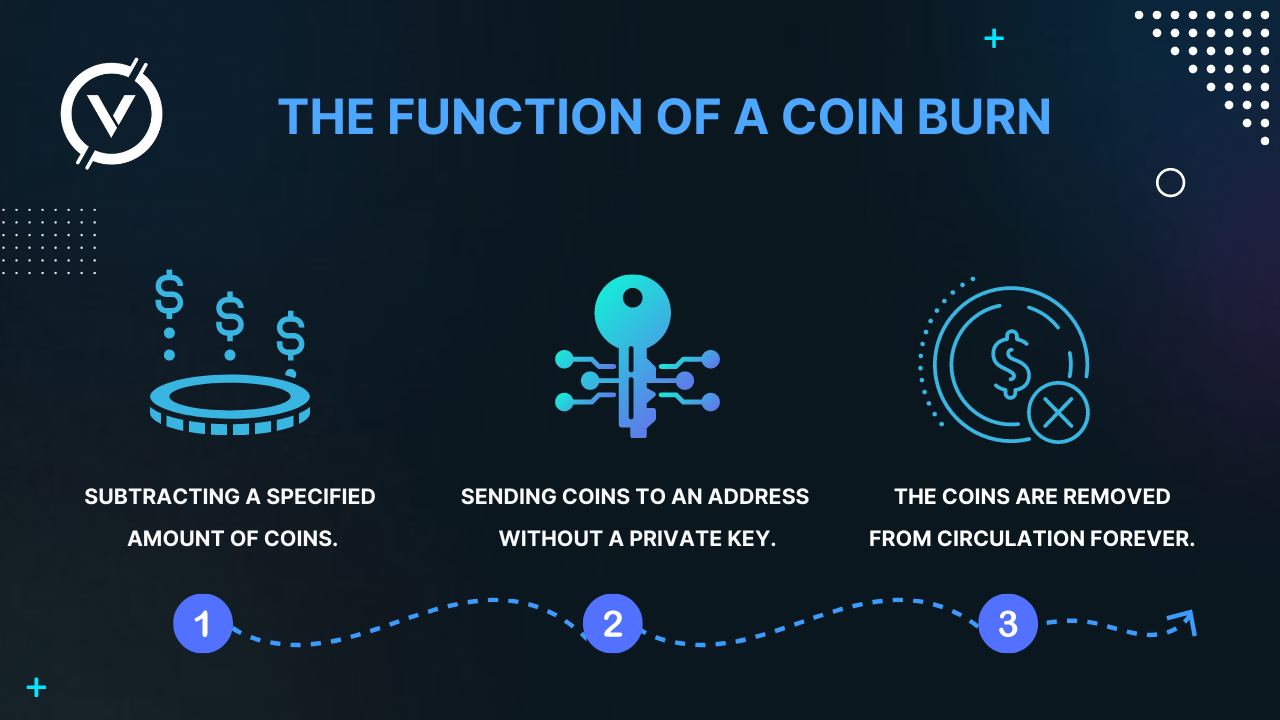

Coin burn occurs not rarely but constantly: there is not the access to the key in the process of sending cryptocurrency tokens to the wallet. It means that the tokens that are lost in such a way will be lost forever.

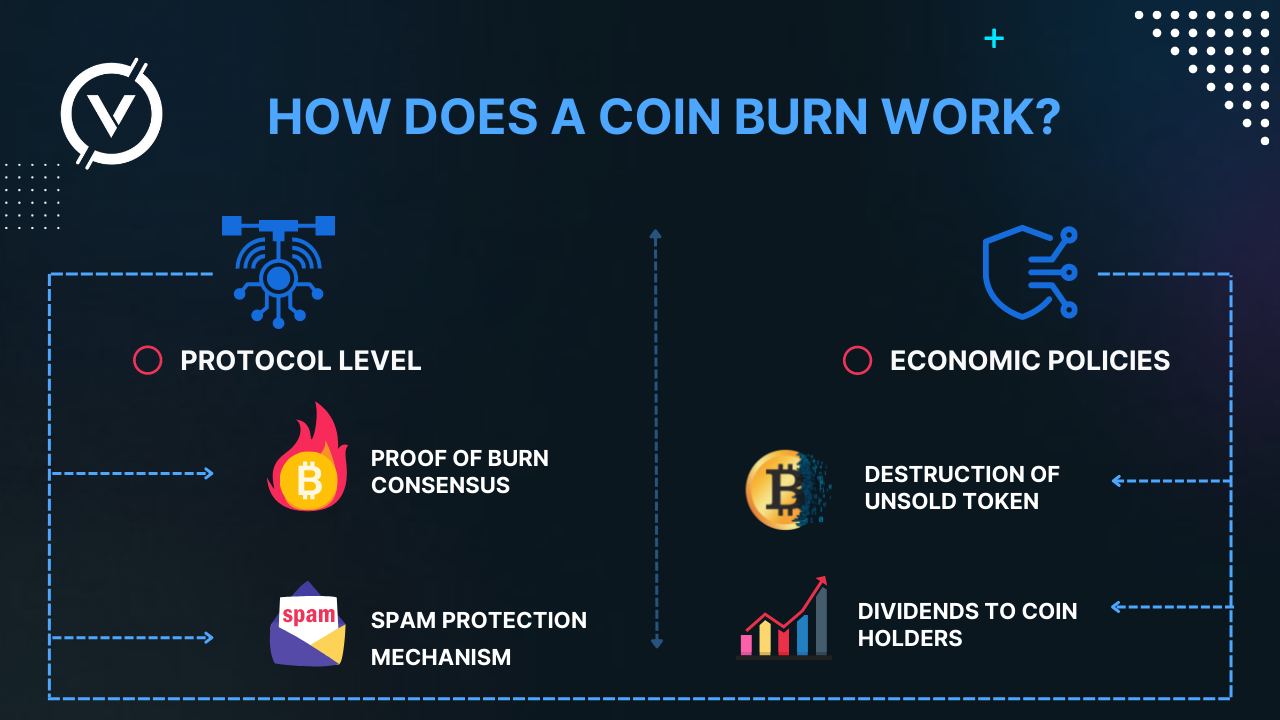

How Does a Coin Burn work?

How does a token burn happen? Let’s consider this situation. At first, holders of cryptocurrency call the burn function and say that they would like to burn a certain amount of coins. After that, smart contracts verify that the users have the coins in their wallet and that the number of coins is really valid. Then in case there are not enough sums of coins, a coin burn cannot pass. If there are enough coins, then the necessary amount of coins will be taken from that wallet. The total supply of that coin will be updated. In this case it means the coins were burnt.

Please, mind that if one executes the burn function to burn one’s coins, they will be destroyed for sure. After the situation when coins are burnt, there is no possibility to take them back.

The function of a Coin Burn

At first the Binance Chain was launched. Afterwards, the BNB ERC-20 tokens were swapped by Binance Coins. Consequently, the Coin Burn processes occur on the Binance Chain. Actually, they do not happen on Ethereum.

We should keep in mind that BNB ERC-20 coin burns were ‘replicated’ on the Binance Chain. It was done so as to make sure that the total supply stays the same. The possibility of checking such burning transactions can be on the Binance Chain Explorer. Does the current BNB coin burn mechanism rely on a smart contract? No, it doesn’t. It is done on the Binance Chain.

What about VSW - Venera Swap token burn?

We have Hybrid Burning Mechanism

We have implemented a burning mechanism that will ensure VSW is regularly bought back and distributed to iVSW holders. For example:

"Deposit Fees" & "VSW Fees"

1% Deposit fee will be charged on Boosted farms & pools (temporally only)*;

1% Deposit fee on selected normal farms (temporally only)*;

80% of the "Deposit Fee" will be used to BUYBACK VSW and then distributed it back to iVSW holders;

20% of the "Deposit Fee" will be held for VSW Development & Marketing

*Will remain for a period of time until enough fees are gathered to move into the next step.