Introduction

Can you name yourself a thoughtful investor? The positive answer to the question: ‘Do you always search for reliable data, in case you want to buy in or sell out of the crypto market?’ In case the answer is positive, the possibility of being a great investor is wonderful!

Moreover, you can find some charts for analyses, fundamentals, as well as market sentiment to tap into it. However, remember, please, that we should not waste our time on studying every metric and index available. It is really a waste of our valuable time! Thanks to Greed Index and Crypto Fear, there is a possibility of giving a look at market fear and greed (due to sentiment& fundamental data). For sure, we should not trust only the indicator. Nevertheless, you will be given the chance of learning about markets.

What is an index?

Have you ever met the definition of ‘index’? As a rule, an index gets various data points and mixes them with a single statistical measure. Take the Dow Jones Industrial Average (DJIA) as an example. The matter is that it is a marvelous index that observes the stock market. There are a lot of possibilities for traders and investors to purchase DJIA in order to obtain a mixed exposure to these companies' stocks.

It should be mentioned that the Crypto Fear and Greed Index is a weighted estimation of market data, but at this point all the similarities finish. The Crypto Fear and Greed Index is only a market indicator that can complement the analysis.

What is a market indicator?

Obviously, it is a cool thing. It can help to analyze market data very easily. Indicators can be stated in different ways of market analysis: technical, fundamental, as well as sentiment analysis. For example, technical analysis indicators deal with analyzing prices, trading volume and other data.

As far as Fundamental analysis is concerned, indicators take another approach. In case Want to find a stock and a token? You should name the basis of your projects. It can consist of the number of users as well as total market value.

In addition, we have got market sentiment indicators. They show the feelings and thoughts of investors or traders. Obviously, crypto research trusts analyzing social media, the community, and public opinion.

What is a Fear and Greed Index?

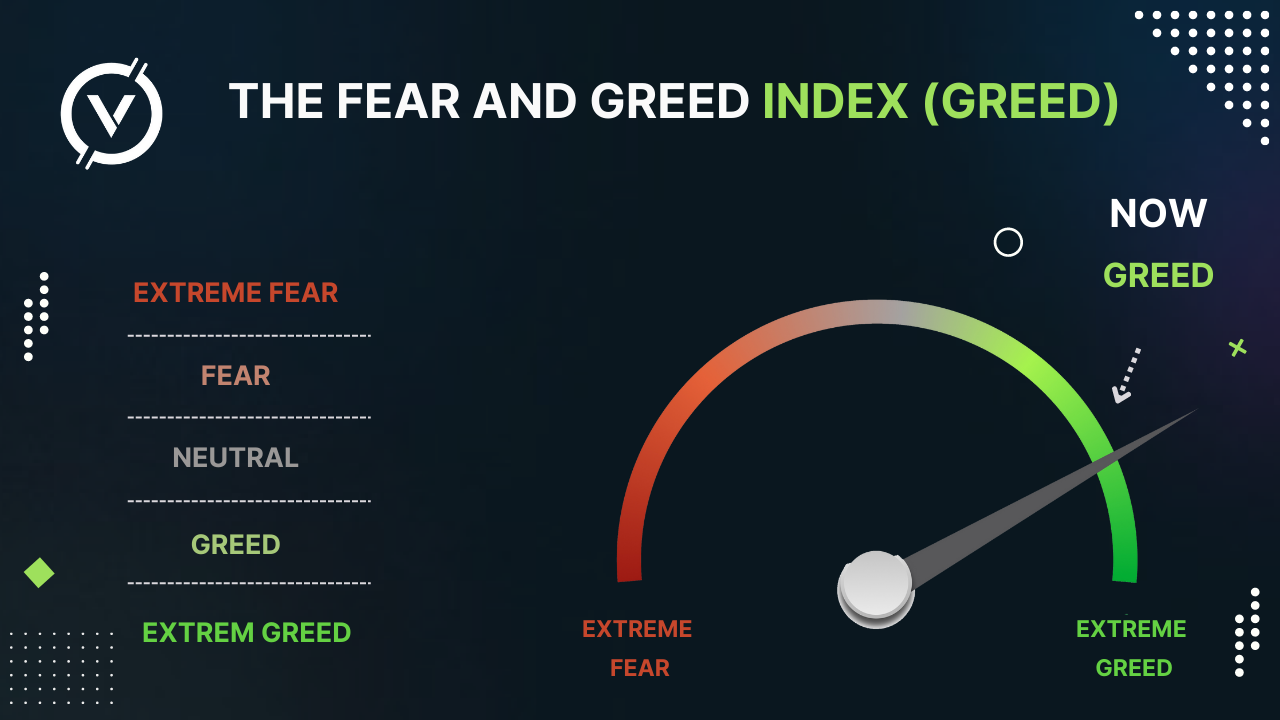

Why was the Fear and Greed Index created by CNNMoney? The answer is simple: to analyze market sentiment and, consequently, find stocks and shares. The Crypto Fear and Greed Index analyzes a basket of various trends and market indicators. After that it becomes easy to decide if the market participants have any fear or greed. What do the scores mean? For example, a score ‘0’ equals huge fear. A score of ‘100’ shows huge greed. A score ‘50’, in its turn, shows the market is really neutral at this rate.

When cryptocurrencies are not valued in a proper way, we deal with a fearful market. The main cause of the enormous rate of panic is considered to be uncontrolled fear in a market. For sure, the existence of fear does not obviously show that the market has entered into a long-term bearish way. In such a situation we can observe a short or mid-term reference to overall market sentiment.

In comparison with fear we can deal with greed. Bad news for greedy investors: it can lead to overvaluatio. Moreover, a constantly increasing level of greed may end up excess demand and artificially inflating the price.

How does the Crypto Fear and Greed Index work?

Well, so as to understand the principles of work, let’s look into the system. The index's scale can be separated into some groups:

- 0-24: Extreme fear (orange)

- 25-49: Fear (amber/yellow)

- 50-74: Greed (light green)

- 75-100: Extreme greed (in green colour)

There are also five various weighted market factors. Here they are:

- Volatility (twenty-five percent). Volatility values the present value of Bitcoin with averages from the last thirty and ninety days.

- Market momentum/volume (twenty-five percent). We can compare Bitcoin's present-day trading volume and market momentum. They are combined.

- Social media (15% of the index). The ‘social media factor’ analyzes the number of Twitter hashtags regarding Bitcoin. The interaction rate is analyzed even more.

- Bitcoin dominance (ten percent). Of course, the data shows BTC's dominance at the market.

- Google Trends (10% of the index). At first we can analyze Google Trends data for Bitcoin-correlated search queries. Then the index will give insights concerning market sentiment.

Why is the Crypto Fear and Greed Index useful?

‘I want to check market sentiment changes. What should I do?’ The Crypto Fear and Greed Index is an outstanding tool for your aim. Huge swings can give you a chance to enter or exit before the rest of the market follows the trend.

Of course, if you are interested in this topic, we can tell you that the index proves to be helpful in finding a buying opportunity. With the help of this we can observe the sell-off at markets. Thanks to the index, we can observe the mood of investors and traders in the market.

Closing thoughts

If we would like to obtain and sum up a great number of fundamental and market sentiment metrics, the Crypto Fear and Greed Index is a marvelous way to do it. Do not waste your time; just trust the indicator so as to track social media, Google Trends, and other data. When the data work, you can drink a cup of strong coffee and just enjoy your life!