DEX acts as a platform for matching bids to buy or sell assets of users to trade directly between members (peer-to-peer) without any financial intermediaries.

However, most of the existing exchanges, which call themselves decentralized, in fact, are not completely so: they use their own servers to store data on trades and orders to buy or sell users' assets, but the private keys are kept by the users themselves.

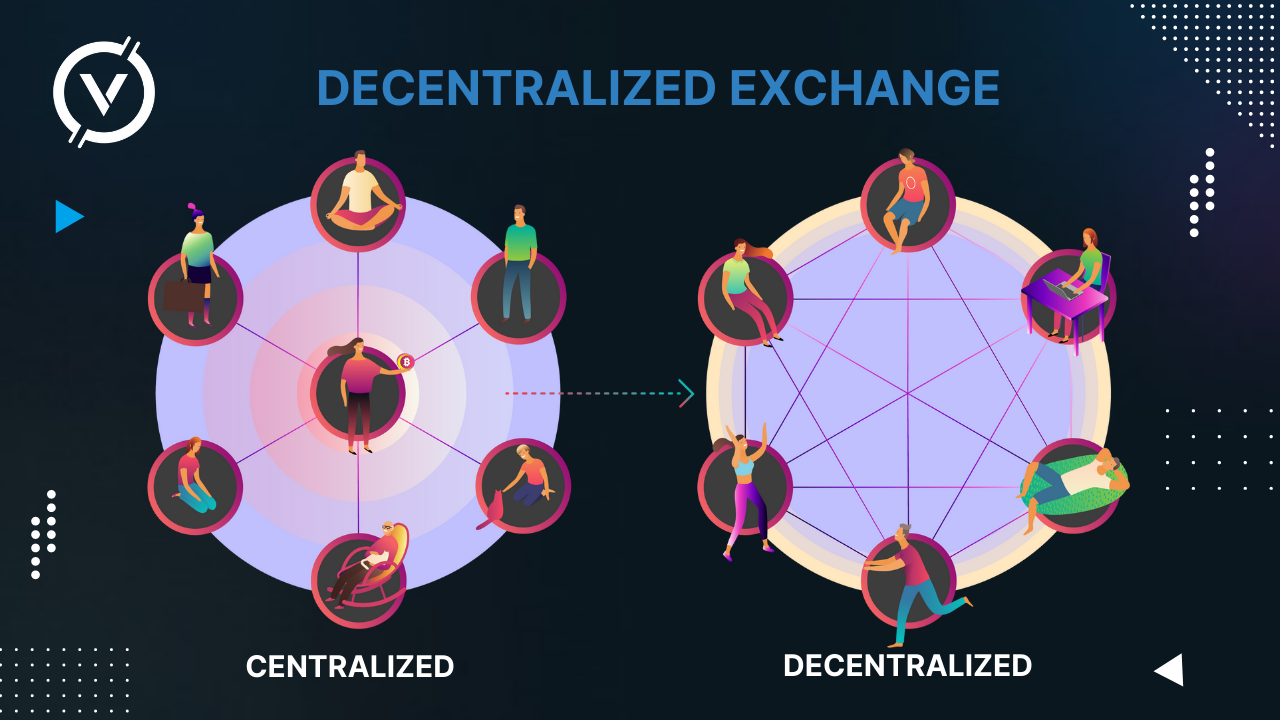

How are decentralized exchanges different from centralized exchanges?

Centralized exchanges are managed by a specific company or person who is focused on generating profits. Managers of exchanges are responsible for the protection of user data and information on trades, fully control the platform and make decisions important to the development of the project.

Decentralized exchanges use a distributed ledger (blockchain) to store and process all (or almost all) data and provide the technical possibility of direct interaction between transaction participants.

The most popular decentralized exchanges?

- Uniswap;

- IDEX;

- Waves Dex;

- Bancor Network;

- Switcheo Network.

- And, of course, Venera Swap

Today there are more than two hundred fully working decentralized exchanges, but now it is hard to compare this number with the number of their centralized counterparts, which, apparently, can exceed several thousand.

Of course, Venera Swap is a decentralized exchange that offers Binance-inclusive farming pairs, low trading fees, and a simple as well as marvelous user experience. Please, call it the latest Automated Market Maker (AMM) on Binance Smart Chain Network. So, nice to meet you!

What are the main advantages of decentralized exchanges?

Most of the strengths of decentralized exchanges derive from their distributed architecture and the lack of a single control center. Here are a few key advantages:

- Decentralized exchanges provide complete anonymity to the user;

- A decentralized exchange does not store user assets, so that neither hacker attacks nor a complete collapse of the exchange itself will threaten the loss of funds;

- A decentralized exchange does not have a single entry point through which all assets and data can be accessed, which makes it difficult for hackers and makes the attack itself pointless;

- The decentralized exchange does not have any personal accounts, does not require verification, and does not even need to specify an email, so no one can use or steal personal user data;

- a decentralized exchange has no management with an interest in manipulating prices within the exchange;

- Because the exchange has a distributed architecture, the authorities can not close it or freeze your account.

Thus, decentralized DEX exchanges give you full control over your own funds.

What are the main disadvantages of decentralized exchanges?

- Many options for traders, such as stop loss, margin trading, or banding, are not available to users of most decentralized exchanges;

- Decentralized exchanges typically have a smaller liquidity pool compared to centralized venues;

- a decentralized exchange, by definition, may not have a help desk capable of affecting transactions or user accounts;

- since many decentralized exchanges are governed by smart contracts, cryptocurrencies that do not support interaction with smart contracts cannot be traded on them.

How are decentralized exchanges regulated?

In the U.S., regulators are trying to apply the existing legal framework, and in Singapore, authorities are trying to create a new regulatory framework for the operation of such exchanges. However, there is no unambiguous position on decentralized exchanges in these countries, and in other countries, decentralized exchanges are not regulated at all.

This results in problems with determining who is responsible in case of any violation, difficulties with the verification of trading activity and identifying possible violations. For the same reason, some already existing regulations applicable to centralized exchanges cannot be applied to decentralized exchanges.

How will the concept of a decentralized exchange evolve?

It is believed that centralized exchanges will gradually introduce the functionality of decentralized exchanges, and therefore the future of the online exchanges is somewhere in the middle, offering the user the advantages of both types of exchanges. In general, decentralized exchanges are considered the most successful solution for serving the broad masses of cryptocurrency users.

Nevertheless, the problems of blockchain scaling as well as the mass adoption of cryptocurrency remain unresolved. Until all these problems are solved, decentralized exchanges are likely to remain a purely niche product.

You will find a complete user guide on this page