While Queen Elizabeth rules the United Kingdom and fourteen Commonwealth realms very successfully and greatly, the phenomenon ‘cryptocurrency’ is ruling the whole world at all. Day after day, countless traders demand for cryptocurrency exchanges to do trading. It should be noted, that currencies are digital so they do not have a chance to be counterfeited. For this reason investors long for crypto exchange services. For sure, the main part in the thriving of the blockchain industry belongs to crypto exchanges.

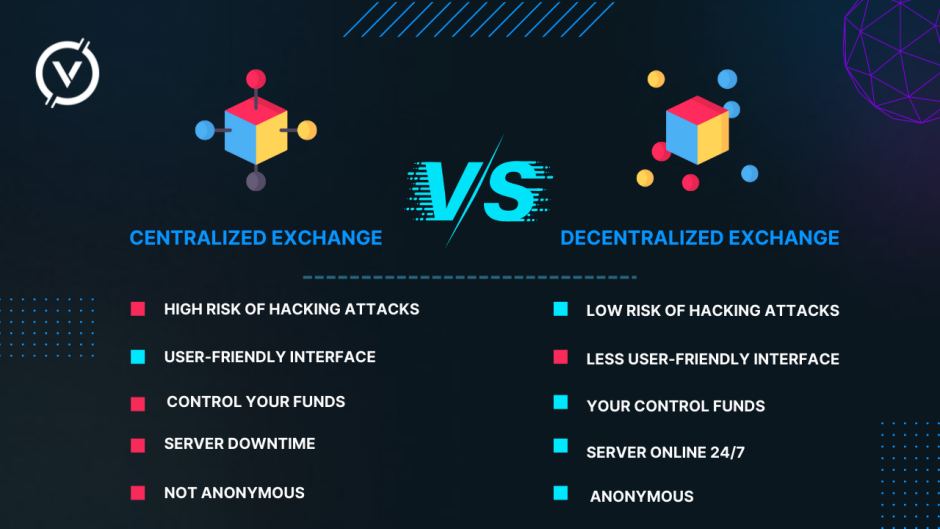

One cannot say that we are rolling in crypto exchanges because there are only two types of them: a centralized cryptocurrency exchange and a decentralized cryptocurrency exchange. It is hard to define which exchange is cooler. Nevertheless, it is predicted that these two variants will go on coexisting.

As not to jump the gun, we will find out what a cryptocurrency exchange is. To start with, centralized crypto exchanges are one of the major means of transacting for various digital currency investors. Centralized cryptocurrency exchanges stand as online platforms aimed at buying and selling cryptocurrencies. As we see from its name, centralized cryptocurrency exchanges perform as a third party between buyers and sellers. A great number of crypto transactions are processed with the help of centralized exchanges because the latter ones are really reliable and trustworthy.

Secondly, centralized cryptocurrency exchanges ask customers to verify personal data. In case customers are organizations, they are asked to provide their corporate information for verification. Thus, centralized cryptocurrency exchanges are rather popular with crypto enthusiasts as they give flat pairs at stable prices. Thirdly, if you are a verified user, you can take the best part of it and write to the support team of the exchange if any technical error appear or you lose your password (God forbid!).

The main difference of a decentralized crypto exchange (DEX) is missing a third-party intervention. Such exchanges do not depend on a third party and funds are kept on the blockchain. Peer-to-peer trading also takes place in this case due to requiring the use of an escrow system and proxy tokens. It means that a decentralized crypto exchange does not support the trading of fiat currencies for cryptocurrencies. DEXs use smart contracts, algorithms that self-execute when preset conditions are fulfilled.

Now we should have a deep look into the differences between centralized vs decentralized cryptocurrency. It will help to make up our mind and choose the most appropriate model of the discussed.

1) It would be interesting to see how the types deal with security as it remains a most important question in the modern world. A centralized crypto exchange provides more standard forms of security regarding insurance as well as regulatory compliance. Know Your Customer verification and anti-money laundering provisions get generally included in compliance.

A decentralized crypto exchange shows security in another way: it prevents market manipulation. It occurs because of blockchain technology when all transactions are kept on the chain, so they are traceable. It differs a decentralized crypto exchange from a centralized crypto exchange in a beneficial way.

2) If you are interested in privacy, choose a decentralized crypto exchange because it is its strong suit. It does not make users verify any measures whatsoever. It means that peer-to-peer transactions let traders implement trades with anonymity.

3) Unfortunately, it happens that people of several countries can be unbanked for different reasons. Nevertheless, do not give up, please! Because a decentralised exchange provides trading based on peer-to-peer transactions, the mentioned people can still trade crypto without being excluded simply because of the country they are resident of.

Furthermore, one should not forget that many CEXs are notorious for charging exorbitant fees. DEXs often charge such a negligible trading fee that it does not cause the attention of traders.

4) As far as trust is concerned, a centralized exchange performs as a trusted third party to ease trades. They hold their earned reputation to increase their investor confidence. Compared to it, with a DEX, greater ownership over one’s own assets is in need of learning more about how it all acts. Greater knowledge makes security better and protection from malicious third parties — but of course, it is a cost of self-custody.

5) Besides, a centralized crypto exchange tends to offer a much greater amount of liquidity (and trading volume) in comparison with a decentralized crypto exchange. This occurs only partly since users are not able to buy crypto with fiat directly on DEXs. Thus, traders have to transact at first per a CEX to access their preferred fiat-crypto pairs. On a decentralised exchange, users have a possibility of trading only crypto-crypto pairs.

It follows that DEXs have a variety of structures for users, which mainly affects how the exchange secures liquidity. DEXs have transitioned to adopting the automated market maker model as well as liquidity pools, swaps, a combination of these and other financial tools.

However, not everything is going so great. Like any other models, crypto exchanges have their disadvantages. Hacking risk and transaction fees are weak points of a centralized exchange. We know that companies keep users’ data and this information can be in danger of hacking risk or cybersecurity risk.

Moreover, a decent sum of fees for the services a centralized exchanges offer is charged. It should be noted that taxation is not applicable while transacting in cryptocurrencies, the charges imposed by a centralized exchange form an important financial cost.

Now let us try to analyze the disadvantages of decentralized exchanges. It is undeniable that the main minus of this type of exchanges is it does not let the trading of fiat for digital currencies. In this case, it becomes inappropriate for people who do not keep cryptocurrencies any longer or who would like to liquidate their cryptocurrencies as per ease.

It is a well-known fact that decentralized exchanges demand users to get familiar with a really more difficult process and do not provide methods to recover password providing the password to crypto wallets are lost in contrast to a centralized exchange which offers its own platform to transact.

In addition, one more disadvantage is liquidity. As decentralized exchanges are very illiquid, they can sometimes provide liquidity constraints. In such a situation people cannot transact seamlessly in emergencies. It is important because it can result in higher spreads as compared to transacting in centralized exchanges.

The most satisfactory conclusion that we can come to is to choose between centralized vs decentralized exchanges only on your own. All your success is going to depend on your choice, so be the person who you trust absolutely. In case you are for a decentralized exchange, you should have a higher level of responsibility in order to safeguard your assets. Please, never invest something you are not ready to lose. May the Crypto Be with You!