Futures and forward contracts are a way of trading interaction in which you can ignore the dynamics of the price of a commodity, since it is standard and does not change until the end of the contract term.

For example, you agree to buy an asset in the future at a fixed price, and if it changes due to market fluctuations, this will not affect your contract in any way.

There is some difference between forward and futures contracts. In fact, it's the same thing, but there are special exchanges for futures trading, and all aspects of interaction are fixed in a legal agreement. In addition, forward contracts are fully redeemed after expiration, and futures contracts can then be extended in various ways.

Forward contract

The forward's price and settlement date are set at the time of signing the contract. The settlement date for each forward remains unchanged, that is, all forward contracts for a specific underlying asset are calculated on the expiration date of the contract.

Forward contracts are financial agreements between buyers and sellers. By entering into a forward contract, the parties agree to sell the relevant asset at a predetermined price on an agreed date in the future.

This category of derivatives forms a private agreement between the two parties. Forwards are traded only on an over-the-counter basis. Nevertheless, these contracts are quite flexible in terms of conditions.

Futures contracts

Futures contracts, also known as futures, have a lot in common with forwards, since they also oblige the parties to buy or sell the corresponding asset at an agreed price within a specified time period. This contract is a publicly available agreement.

Unlike forwards, futures agreements are considered highly speculative investments because it is almost impossible to predict whether the price of the underlying asset will rise or fall. Uncertainty means that if the investor's assumption about the price movement is not confirmed, he is exposed to the risk of losing significant amounts of money.

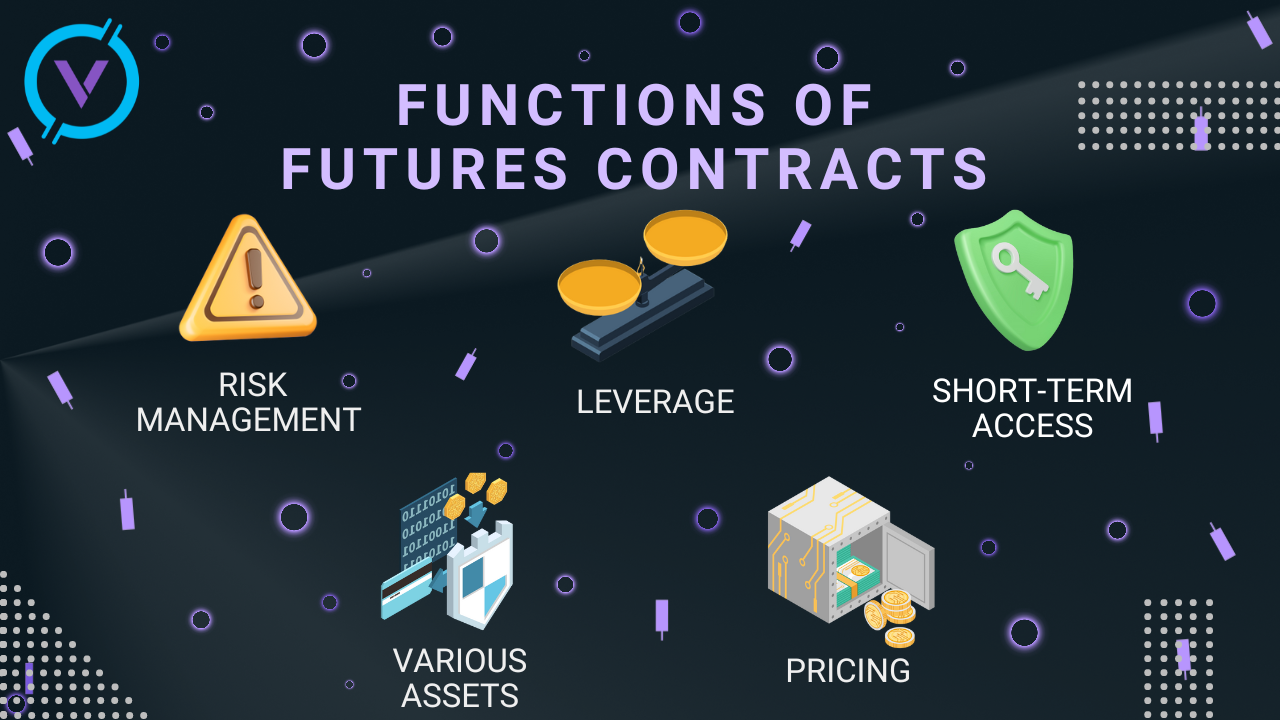

Functions of futures contracts:

1. Risk management

Futures attract investors with a guarantee of low risk — the value of the asset is calculated daily and is closely related to the current market rates. If you conclude a contract for the supply of, for example, food for a certain amount now, then you can not be afraid of a lack of demand in the future, price fluctuations and market instability in general.

2. Leverage

In futures trading, leverage is the ability to control a high—value contract with much less investment through the use of borrowed capital. This gives the trader additional purchasing power and allows traders to control larger positions with minimal capital risk.

3. Short-term access

You have the opportunity to get short-term access to the asset.

4. Various assets

You can exchange different assets without having to exchange them physically, for example, oil.

5. Pricing

Supply meets demand. Therefore, the price of oil can be determined by the demand in the futures markets

Settlement mechanisms

In a simplified form, futures is a guarantee obligation to provide goods at a certain price by a certain date. When this deadline comes, the contract is "repaid" and the exchange participants begin to settle. There are usually two methods used.

- Physical settlement. The simplest option is the "short side" /the seller transfers the goods to the "long side"/the buyer. However, less than 10 percent of all transactions on futures markets end in this way.

- Cash settlement. Instead of physical exchange, monetary equivalents corresponding to the real value of the goods at the time of completion of the transaction are used. Most often, this method is used when working with assets that are technically difficult to exchange.

The second option is much more popular, because it is much easier to work with cash equivalents than with real assets. Fortunately, the calculation method is prescribed at the conclusion of a futures contract.

Exit strategies for futures contracts

There are three main scenarios:

1. Execution of the contract

Both participants fulfill their obligations, one receives the goods, the second receives money. A rather rare event – as already specified, less than 10 percent of contracts end this way.

2. Reverse transaction

Something like "resale". If, for example, a trader has 30 purchase contracts (30 short positions), then he can open 30 similar long ones ending on the same day as the short ones. This allows you to compensate for losses or realize profits before the date of the official completion of the contract.

3. Rollover or position transfer

A kind of "extension" of the contract. If the mentioned trader has the same 30 long positions, then on the day of their completion he can sell them and immediately buy new ones, the term of which is extended for the time period he needs.

It is desirable to do this simultaneously, within the framework of a single transaction. It is usually used in situations when a trader does not want to lose their market positions.

Futures contracts price patterns: contango and normal backwardation

The market price of contracts is constantly changing in response to fluctuations in purchases and sales throughout the period.

Below we will tell you more about the price models, which are called contango (1) and the usual backwardation (3). And they are directly related to the expected spot price (2) the asset at the expiration date (4). This is shown in the picture below.

1. Contango

Contango is a market situation in which the value of exchange contracts is much cheaper, because the deadline for execution comes either soon or right now.

Contango is applied to products with a long shelf life. Futures contracts assume that the supply of raw materials will be made not when the contract was signed, but after a month, six months.

2. Expected spot price

This is the expected price of the asset at the time of calculation

3. Backwardation

The reverse effect of contango is called backwardation or backwardation. In this case, the price of futures contracts is lower than the spot price of the underlying asset. Unlike contango, the chart is directed downward, that is, the price decreases from the maturity of one contract to the next.

In this case, the demand for the asset is not so high, and therefore it is concluded that the price of further futures contracts becomes lower. Here, too, the futures price tends to converge with the spot price as the contract terms approach.

4. Expiration date

The last day of trading activity before settlement.

Summery

Futures and forward contracts can be a good option for both hedgers and speculators, but do not forget: before proceeding to active trading, it is necessary to conduct an in-depth market research.