Do you believe that our world is based on tortoises and some elephants?

Some people do. But no one knows for sure. What we know for sure is that liquidity pools can be named one of the main foundation technologies. They occur in the DeFi ecosystem.

Why are liquidity pools so significant?

The matter is that liquidity pools are really important concerning AMM (automated market makers, in other words). They also matter in the sphere of borrow-lend protocols, synthetic assets, on-chain insurance, yield farming as well as gaming. We can count all this staff for so long!

The great idea of liquidity pools can be understood for everybody. The idea consists of the concept that they are just funds thrown together into a large digital amount. Of course, it is difficult to say how people can deal with it, because there are no strict rules regarding this kind of environment: the matter is (not very positive one) that every person can add liquidity to it. In this case it is better to find out in what way DeFi got repeated the case of liquidity pools in general.

Let’s begin!

It is not a secret for anybody that Decentralized Finance gave birth to a new on-chain activity. The sizes of DEX for sure are able to go in for the size on centralized exchanges. Since 2020 there has been a great number of centralized exchanges. We can say for sure that this sphere, in other words ‘ecosystem’, is increasing nowadays. Moreover, a lot of new types of goods and products are being observed.

How has it become in such a way?

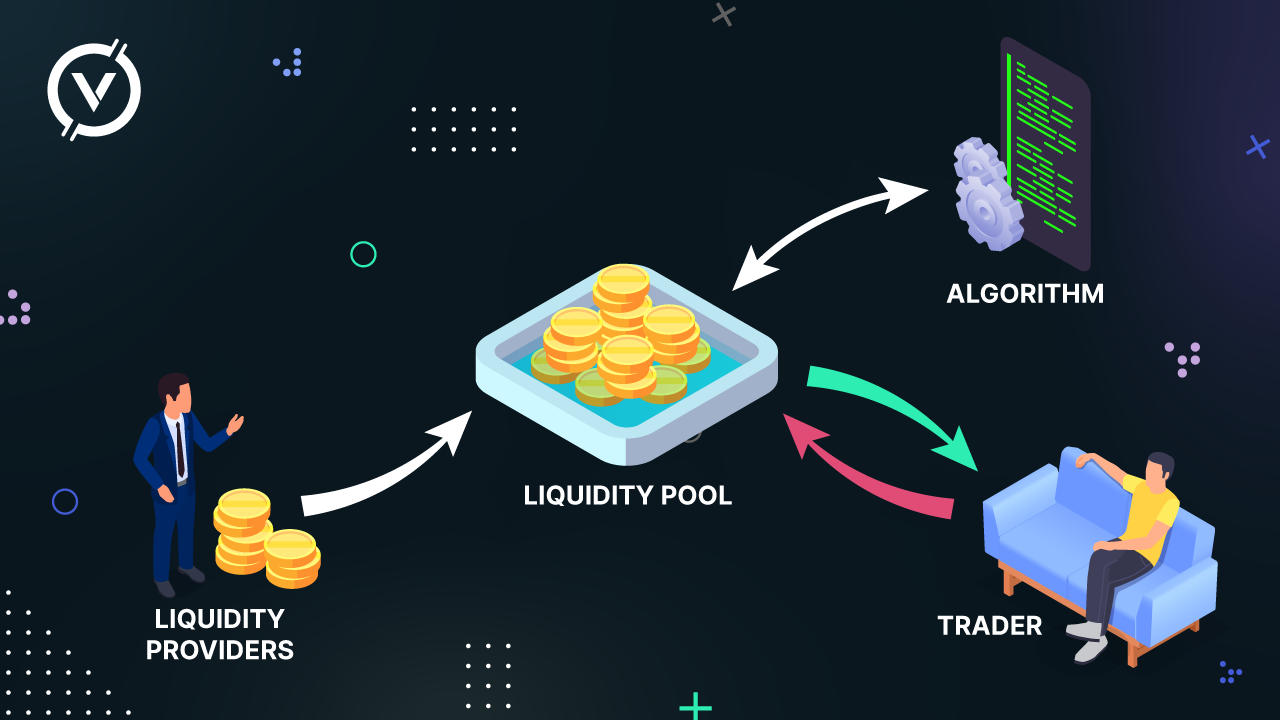

The answer is simple: the liquidity pool. One of the main technologies on the background of all these products is the liquidity pool.

A liquidity pool is…

A liquidity pool versus an order book

Have you ever come across a small building block of each electronic trading – the order book? It is necessary in order to clarify in what way liquidity pools are various. Well, an order book is a gathering of the presently existing and open orders for an exact market.

As well as order books, we should learn the word ‘matching engine’. It is just a system that matches orders. Both the matching engine and the order book are the basis of each centralized exchange (CEX in other words). We can easily and successfully use this method for creating a great exchange and making the creation of system financial markets possible.

Sometimes it occurs that decentralized financial trading can have executing trades on-chain. It will be done without a centralized side keeping the funds. It is really connected with order books. Order books make the procedure so expensive, unfortunately. What is more, the work of market makers also becomes very costly.

What does it imply?

Not very positive news. On-chain order book exchanges become definitely not possible on some blockchains, for instance, Ethereum. It means that the network cannot deal with the throughput in its present state.

Work of liquidity pools

We can say that automated market makers have made this situation absolutely different. They are important things that allow for on-chain trading avoiding the necessity for an order book.

Maybe you consider an order book exchange as peer-to-peer?

It means that buyers and sellers should be connected by the order book. For instance, trading on some DEXs is really peer-to-peer because trades communicate straight between user wallets.

On the contrary, trading with an AMM can differ from it. It will be trading on an AMM as peer-to-contract in this case. In case you make a trade on an AMM, you do not possess a counterparty in the common meaning. Apart from it, you make a trade against the liquidity in the liquidity pool. There is no necessity to be a seller in that exact situation, only enough liquidity in the pool.

Of course, the liquidity has to come from somewhere, and anyone can be a liquidity provider, so they could be viewed as your counterparty in some sense. But, it’s not the same as in the case of the order book model, as you’re interacting with the contract that governs the pool.

Do liquidity pools have risks?

1. If you supply liquidity to an automated market maker, it is necessary to understand the idea named impermanent loss.

Let’s look into this concept now. This means a loss in dollar value in comparison with HODling when people supply liquidity to an automated market maker.

2. If you supply liquidity to an automated market maker, perhaps you are revealed to temporary loss.

From time to time, it can be small; in other cases it is big. Please, analyze some information in case you think about putting funds into a two-sided liquidity pool.

Please, also always pay attention to smart contract risks. In case you deposit funds into a liquidity pool, they are in the pool. Well, when there are technically no middlemen holding your funds, the contract can be thought of as the custodian of the funds.

- If there are some bugs or some sort of exploit through a flash loan, for instance, there is a possibility of losing funds without a chance of recovering them.

Additionally, be aware of projects in which the developers have rights to change the rules governing the pool. It can happen that developers have got an admin key or other various privileged access inside the smart contract code. This makes them potentially do some malicious things. It can be, for example, taking control of the funds in the pool.

How to creat the liquidity pool on Venera Swap?

Conclusion

We can say for sure that a liquidity pool is one of the basic technologies behind the present Decentralized financial technology stack. Liquidity pools make decentralized trading, lending as well as yield generation possible. Without any doubt this direction will be developing and developing.