The beginning of our topic

One of the most striking features of staking is that some people consider it a less resource-intensive variant of mining. This concept includes having funds in a crypto wallet so as to be sure in safety guarantees and operations of blockchain networks. In other words, locking cryptocurrency in order to get rewards is called staking.

Logically, if a person owns a crypto wallet, it will be possible to stake this person’s coins from crypto wallets. If we dive into this sphere, we can notice a lot of exchanges that give a chance of staking to their customers. Such exchanges can make earning rewards very easy for you! Of course, you should have your coins on this exchange in this case.

Without any doubt, there is a great opportunity to understand the concept of staking better: just find out what the principles of PoS working are. Proof of Stake, by the way, a wonderful system that lets blockchains function more properly during maintenance and a decent amount of decentralization. Well, let’s look at the PoS working system.

Proof of Stake Itself

Everybody who meets Bitcoin knows about Proof of Work (PoW). What is it needed for? The answer is simple: for combining transactions into blocks. These blocks, in their turn, build the blockchain. A lot of miners have the goal of solving a very difficult mathematical issue and after solving it, the first person will get the possibility to add the next block to the blockchain, for sure.

It is known that, unfortunately, Proof of Work includes much arbitrary computation. It means that the issue that miners are eager to solve is pointless because it just lets the network stay secure. What are some different ideas in order to maintain decentralized consensus avoiding the high computational expenses? The answer is Proof of Stake.

The great option of this phenomenon is that participants are able to lock their coins and at exact periods, the protocol randomly chooses the right to one of these people to build the next block. Please, be attentive that if a lot of your coins are locked, you will have more chances of being chosen.

Who is the creator of Proof of Stake?

It is considered that Proof of Stake was firstly mentioned by Sunny King and Scott Nadal in 2012 for Peercoin. It was defined as a peer-to-peer cryptocurrency design derived from Satoshi Nakamoto’s Bitcoin.

Afterwards, the Peercoin network was made with a hybrid Proof of Work and Proof of Stake mechanisms. Nevertheless, Proof of Work was not necessary for the long-term sustainability of the network that is why it was neglected. Evidently, a lot of networks trust their security to Proof of Stake.

Have you heard of Delegated Proof of Stake (DPoS)?

Have you ever heard of Delegated Proof of Stake? It was created by Daniel Larimer two years later than its alternative variant – 2012. Delegated Proof of Stake was a part of the BitShares blockchain. After some time, many different networks took this variant.

With Delegated Proof of Stake it is possible to commit coin balances as votes (in this case, voting power is proportional to the number of coins owned). Afterwards, the votes can be used in order to choose a number of people who will be in charge of the blockchain regarding their voters. As a rule, these rewards are shared among chosen people.

The great news is that the Delegated Proof of Stake variant is really able to achieve consensus with a lower number of validating nodes. Otherwise, it can lead to a lower amount of decentralization because the network depends on a not very big part of validating nodes. They participate in the processes of getting consensus and defining key governance features. If you want to show your influence with the help of other participants of the network, you should be familiar with DPoS.

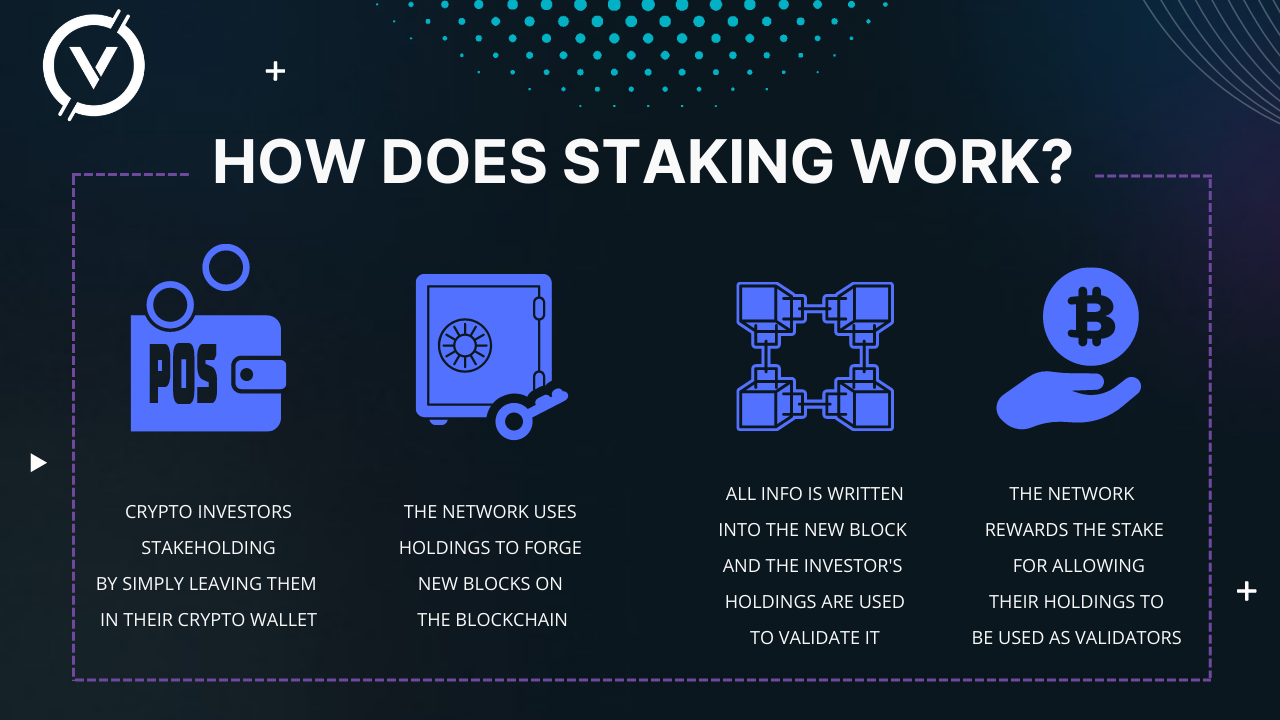

Laws of staking work

Firstly, let’s remember that Proof of Work blockchains depend on mining in order to add new blocks to the blockchain. Secondly, it is the process of staking where Proof of Stake chains create new blocks. Validators in staking are able to

Staking involves validators who exclude their coins that is why these validators can be randomly chosen by the protocol during specific periods to build a block. The bigger the amount of staking is, the higher the opportunity of being chosen is.

We should mention that Proof of Stake varies and each of them can have different currency for staking. For instance, some networks take a two-token system when the rewards are given in a second token.

To dive into practical ways, we can say that staking refers to saving funds in a suitable wallet. It can help us to do various network functions in return for staking rewards.

The calculation of staking rewards

The first thing that needs to be said is that blockchains networks can use various ways of calculating staking rewards. On the one hand, block-by-block basis can be taken into account, on the other hand, staking rewards are considered to be a fixed percentage.

We should pay attention to the following factors:

- how many coins are staked by the validator;

- how long has been staking done;

- how many coins are staked on the network in general;

- the inflation rate.

There are rewards that are shared among validators in the way of compensation for inflation. Inflation motivates people to spend their coins instead of saving them up. This, in turn, can enlarge their usage as cryptocurrency. But with this model, validators can calculate right what staking reward they can expect.

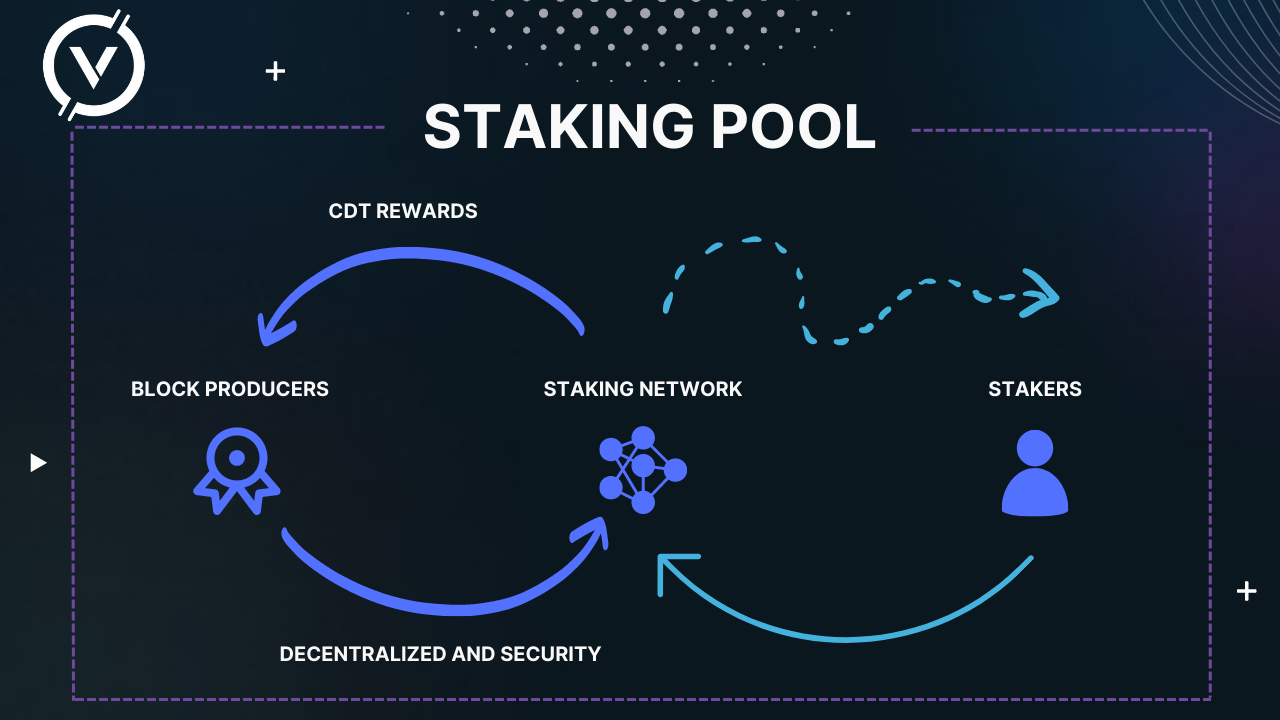

What is a staking pool?

To begin with, a group of coin holders that join their forces in order to double (and even more) their abilities of validating blocks and getting rewards is known as a staking pool. Additionally, they have a possibility to unite their staking force and give the rewards correspondingly to their donations to this pool.

Creating and saving a staking pool usually asks for much time and knowledge. Staking pools favor the most appropriate on networks where the blockade of entry (both technical and financial) is proportional high. As a consequence, many pool offers charge a fee from the staking rewards that are shared with people.

On the contrary, pools can offer extra flexibility for stakers personally. As a rule, the stake should be locked for a certain interval and usually has a removal or unbinding time set by the protocol.

A lot of staking pools ask for a not high minimum stability and add no extra removal times. So, connecting to a staking pool instead of staking solo can become really perfect for newcomers.

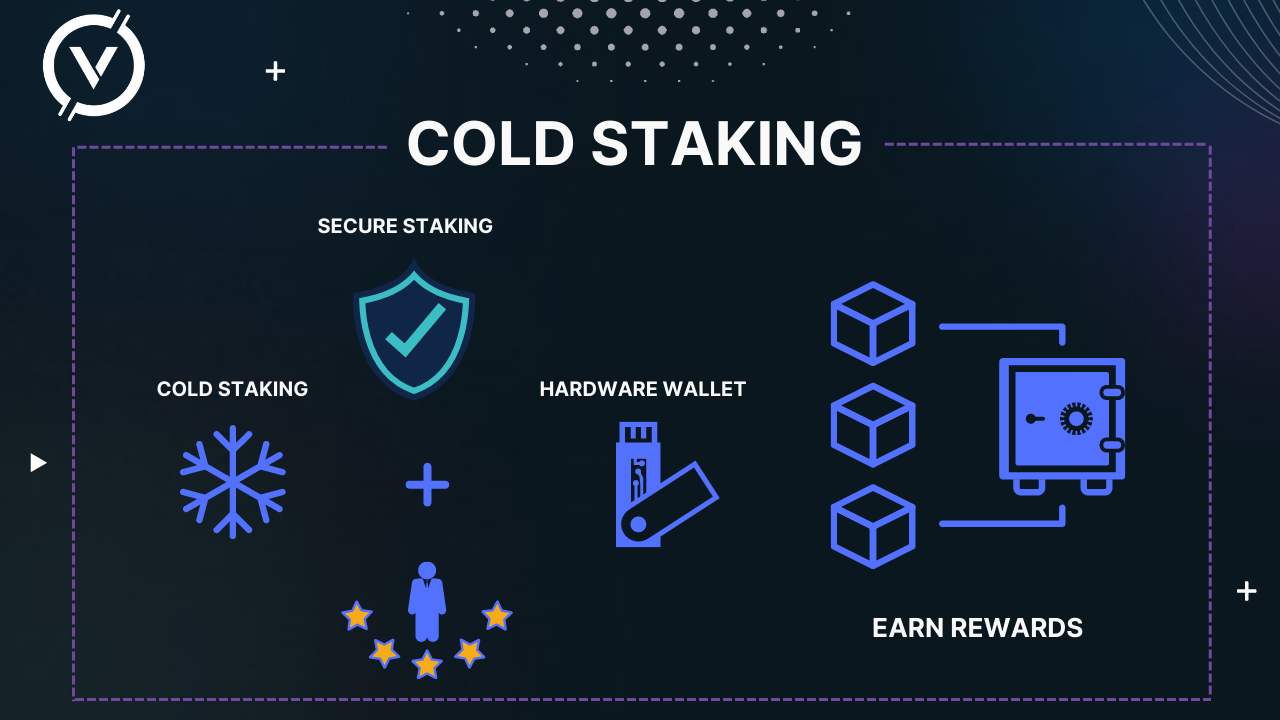

Brrr… Cold staking is here!

Do you have a wallet which is not connected to the Internet? In this case, the process of staking on such a wallet will be called cold staking. You can fulfill it by having a hardware wallet; moreover, it is usually good with an air gap software wallet.

Networks that allow cold staking allow people to stake during securely holding their funds offline. It is worth noting that if the stakeholder replaces their coins from cold storage, they’ll cease getting rewards.

Cold staking is totally appropriate for big stakeholders who would like to ensure enormous protection of their funds during support of the network.

To be continued…

Would you like to take part in the harmony and command of blockchains? We have marvelous news for you: please, take Proof of Stake and staking in notice. Additionally, Proof of Stake and staking are absolutely easy methods to get passive income by simply owning coins. Because of the fact that it is getting really easy to stake, the boundaries of entry to the blockchain system are decreasing.

How to stake on Venera Swap.

- Go to the staking page

- Follow the instructions in the video