ICO stands for an Initial Coin Offering. ICO helps various teams to get funds for any necessary project regarding the cryptocurrency world. The matter is that teams cause blockchain-build tokens in order to sell to supporters at very early stages. People will get tokens, which they will be able to use as well as projects will obtain money to fund further progress. People can use tokens at once or some time later.

Where was the beginning of it? You know, it began in 2014. At first, it was done in order to fund Ethereum. Afterwards, a great number of ventures took as practice to adopt this. It should be noted that it made sense, because a wonderful boom was observed in 2017.

Some people can say that Initial Coin Offering looks like Initial Public Offering (IPO for short). It may be true to some degree, but there are a lot of differences regarding funds.

To begin with, Initial Public Offering helps to make a business that sells a bit of ownership so as to get funds. Otherwise, Initial Coin Offering is used in order to let business get funds for it at the very beginning. It can be really called a mechanism for getting funds.

Without any doubts, Initial Public Offering is a marvelous alternative to common funding concerning startups. For sure, not only it can be used by new startups. Sometimes famous businesses use reverse Initial Public Offering. In this case, users will notice similarities with a common Initial Public Offering. They have similar functionality.

Moreover, a business already has a product and service and affairs a token so as to decentralize the ecosystem. From time to time, they can give ICO to cover a wider range of investors and get funds for a new product.

The Fight Between ICOs and IEOs

Firstly, let’s find out what IEO stands for. Therefore, IEO stands for Initial Exchange Offerings. A very interesting fact that Initial Coin Offerings and Initial Exchange Offerings are really similar. Nevertheless, as a rule, there is one major difference: Initial Exchange Offerings can not be hosted simply with the help of the project’s team, but in a company with a cryptocurrency exchange.

The exchange allies with the team to let its users purchase tokens straight on its platform. Of course, it can be profitable to every part. In case a well respected exchange holds up Initial Exchange Offerings, users have the chance of waiting for the project to have been strictly inspected. The team behind Initial Exchange Offerings profits from increased submission, and the exchange stays to obtain from the progress of the project.

The Fight Between ICOs and STOs

After the discussion of the differences between ICOs and IEOs, let’s delve into STOs. STO is Security Token Offering. Some time ago it was called a ‘brand new ICO’. Regarding a technological point of view, they are totally alike – tokens are made as well as shared in the same way. If we take the legal side into account, nevertheless, they vary absolutely.

Some businesses make a choice to take the STO route as a base to give fairness in the form of tokens. Additionally, the situation will be able to help them be clear of any unreliability. The issuer registers their offering as a securities offering with the pertinent government system, which subjects them to the same treatment as common securities.

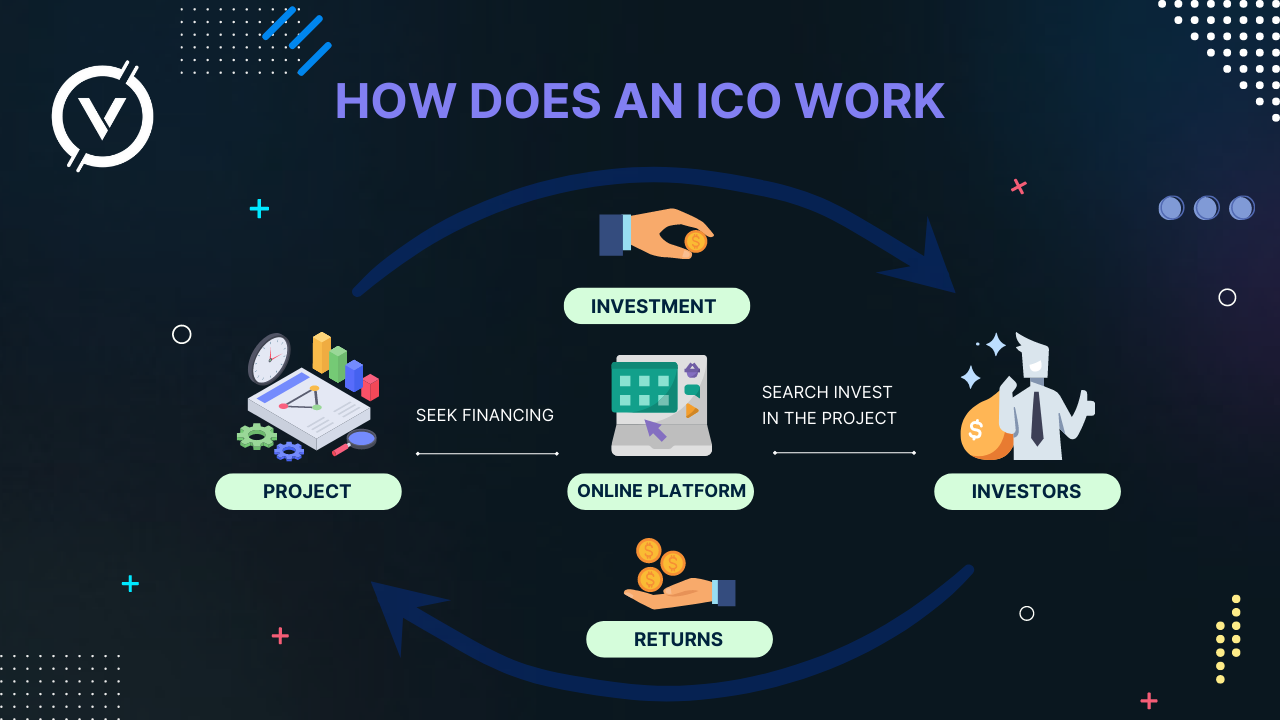

How does an ICO work?

It is a well-known fact that ICOs have a great number of shapes. From time to time, teams that host it will possess a functional blockchain that they will carry on to evolve in the near future. If it happens, people will be able to purchase tokens that are sent to their addresses on the chain.

Nevertheless, the blockchain can not be launched. So, in this case, the tokens will be provided on an accepted one (for instance Ethereum). If the new chain is live, people can swap their tokens for new tokens supplied on top of it.

As a rule, tokens can be issued on a smart-contract chain. Commonly it is done on Ethereum. It was estimated that twenty hundred thousand various Ethereum tokens are upwards nowadays.

Initial Coin Offering is reported in advance and states rules for how it will be done. It can define a timeframe it will work for, execute a difficult cap for the sum of tokens to be sold, or include both.

Who can launch an ICO?

If you need to create and share tokens, the method is really The technology to create and distribute tokens is widely attainable. Nevertheless, there are a lot of legal reflections to pay attention to before holding Initial Coin Offering.

In general, the cryptocurrency world is short of compliance instructions. Moreover, there are a lot of difficult questions that remain nowadays. Some countries do not allow launching Initial Coin Offering completely, but even the most crypto-friendly jurisdictions have yet to give clear law-makings.

Do ICOs have any risks?

We should notice that not each coin is made equal. It should be remembered in case thinking of great returns is an appealing one. In the sphere of crypto, no one can no guarantee a positive ROI (it stands for Return on Investment).

If you are thinking of any tokens, please, do research into them. A wonderful analysis should be done in a proper way. The following questions are to be asked:

- Is the concept viable or not? What issue does it solve?

- In what manner is the supply assigned?

- Is there a necessity for blockchain or token? Is it possible to deal without one?

- Is the team well thought of? Do they have enough skills in order to be successful?

- No way to invest more than you have got. It can be very dangerous, really.

Conclusion

One of the best tools for a project at the very beginning is Initial Coin Offering. It is very effective and profitable. With the help of the starting of Initial Coin Offering and its success, a lot of businesses could obtain funds to develop new protocols and ecosystems.

If you are a buyer, please, be aware of what you are investing in. It should be done on the grounds that there are no guaranteed returns. Please, do not make too risky investments. Stay tuned!

Learn more on this page