Amazing fact:

‘It is not very difficult to do yield farming.’ Moreover, it was written that yield farming would help create much more crypto. Is it really in such a way? Let’s consider it together. Firstly, yield farming really includes the situations when I can lend my funds to others. It is always done with the help of smart contracts (do you remember that it is a great computer program?) When we do this service, we can get fees. It will be crypto.

Can you guess what yield farming is?

Hey, liquidity mining and our guest yield farming are almost twins. They help create a way to generate prizes with the help of crypto possessions. To cut it short, the following fact denotes locking up crypto and then obtaining prizes.

Moreover, staking can be easily compared with yield farming. In what way? One cannot deny that we can find many difficulties concerning their background. Usually, it deals with users. These users are named liquidity providers (LP, if you remember). They, in turn, give funds to liquidity pools.

Would you like to know the definition of a liquidity pool?

Here you are: a liquidity pool means a smart contract. This contract will include funds. If there is liquidity towards the pool, rewards will be given to a liquidity pool.

An interesting fact is that a lot of liquidity pools pay these rewards in the form of multiple tokens, you know. It means that reward tokens later can be transferred to various liquidity pools. It can be done so as to obtain rewards in this place and many other variants. The main point of this phenomenon is: a liquidity provider accumulates funds into a liquidity pool. In its turn, it will get rewards. It is fair, isn’t it?

What does Total Value Locked denote?

In what manner can a person think that the DeFi yield farming scene is profitable or can lead to failure? The way out is to count its health. It is possible to do it with the help of Total Value Locked (in short TVL). TVL will help you count how much crypto is locked.

Additionally, it will help to discover the state of the DeFi along with the yield farming market. If you have a necessity to define the ‘market division’ of various DeFi protocols, it is the best way.

For sure, if you lock a lot of value, it means that you will experience more yield farming in the near future. There are a lot of currencies to your taste: ETH, USD, BTC, etc. But the VSW the best! Try, choose, enjoy!

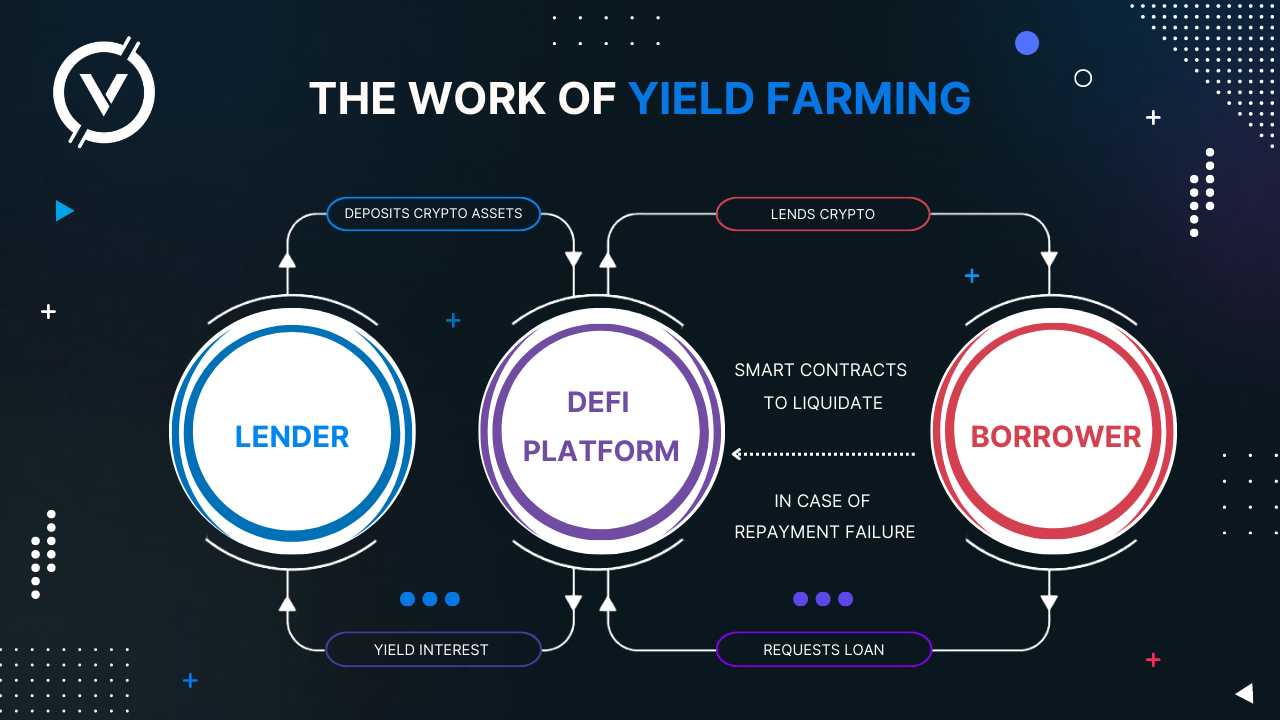

The work of yield farming

Perhaps, you have heard about automated market makers. It is also called AMM in short. Well, we can compare yield farming with AMM. It generally includes liquidity providers as well as liquidity pools. Do you know the principles of its working?

To begin with, funds are put into a liquidity pool by liquidity providers. This pool ‘hires’ a marketplace. At this marketplace people are able to give, borrow, and even exchange tokens. If we use the platforms, it means suffering from fees. Afterwards, fees will be given to liquidity providers (of course, as reported by the share of the liquidity pool). You have just learnt the principles of AMM working.

Unfortunately, sometimes it is impossible to purchase a token on the open market. Sometimes people experience the situation when a token is available but in small quantity. It is also sad, for sure. Nevertheless, it can be accumulated if providing liquidity to the exact pool. Please, keep in mind that the regulations of distribution are dependent on the application of the protocol.

Platforms and protocols

Is it possible to obtain these yield farming prizes or, in other words, rewards? Please, remember, that a set way to do yield farming does not exist, unfortunately or fortunately. Actually, yield farming methods can be very quick. Of course, every platform as well as method has its own opportunities and risks. In case you would like to deal with yield farming, you should learn the rules according to which decentralized liquidity protocols work.

For instance, we can put our funds into a smart contract and get rewards. Super! But the implementations can vary greatly. So always be in control of your money!

Let’s see at great opportunities concerning Venera Swap protocol:

How to Farm VSW on Venera Swap

Closing thoughts

Fashion varies. Technologies vary. Crypto world is also changing nowadays. We should conclude that yield farming is on hype. Can anybody predict the future of it? Can anybody predict what will be with the world of DeFi? No way.

The best way is to concentrate on the present. It can be stated that doubtful liquidity protocols, different DeFi goods are really on the top of finance, economics and so on.

But please, remember: in case you would like to have a very accessible system in the financial world, be sure that DeFi money markets can become your friends.