Especially everyone is familiar with it, particularly those who adhere to the bitcoin industry. It can be a little more challenging to define what it is.

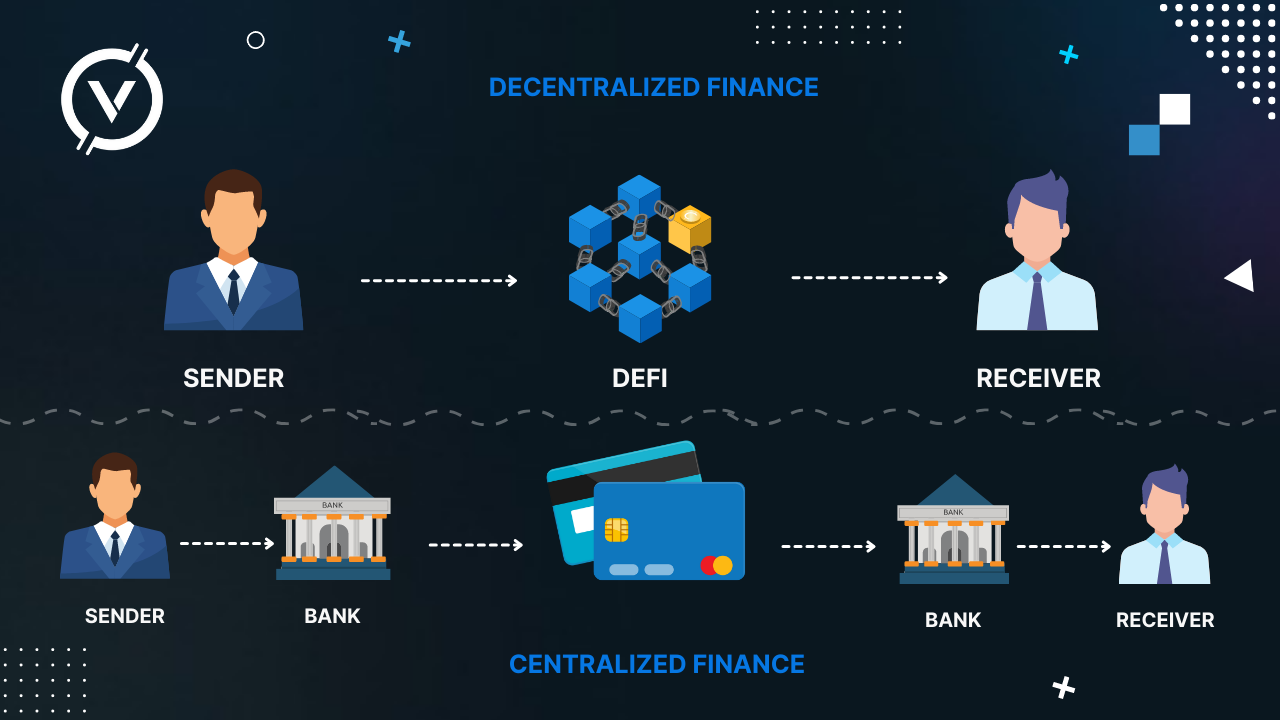

DeFi stands for decentralized monetary applications. It can apply to any financial or payment system. These are distributed without using a mediator or an entity to centralize them.

Let's analyze your financial situation to help you visualize it. And understand the situation well. For example, you will get the money from the bank. You ask that the foundation provide you with access to someone else's money. It is the rule that we all know.

Consider what will happen if the financial institution is removed from the equation. The simple answer is the bank charges will not exist.

You would be able to get a car loan for a lot less money. Even you offered your cash. It would be worth a lot more.

DeFi methods are used Blockchain technology. It enables each of these In the end.

It's worth considering some of the most important benefits of adopting DeFi and learning more about the process that led to them.

These decentralized applications must be open source. And run without the involvement of a centralized authority. Changes are made on time. On the Blockchain, protocols and information are recorded. Everyone on the decentralized network has access to it, and it is encrypted.

A change in public opinion from traditional banking and moving toward DeFi would entail a significant shift in how people communicate with different types of money.

We use legitimate financial institutions. And exchanges for converting fiat currencies to friends and relatives. Digitally, DeFi lacks the flaws and downsides that we think are needed.

Without the Use of an Exchange

Keep in mind not having to pay broker fees and not worrying about the risk of hardship.

As a result of this decision, many systems for this purpose were popular this year. It is the second most popular DeFi category.

Payment without the need of a middleman

Repayment strategies are used to create a without middlemen. It is the third most crucial DeFi application in the world.

It is nothing new in the crypto world. It's great to analyze how different programs deal with the bitcoin problem. Bitcoin purchases have a smooth performance issue.

As a result, people generate fake coins backed by BTC. They do not need to use the BTC Blockchain to trade. They are making Blockchain transactions more efficient and less expensive and making Bitcoin a superior settlement mechanism. 0.5 percent of all bitcoins in circulation, including renBTC and WBTC. They are DeFi-protected on the Ethereum blockchain.

Loans Aren't Everything.

Auto loans are something DeFi should do. In this sector, DeFi financing systems are the most popular. Only three systems have more than $4 billion in locked value (real estate has agreed to complete DeFi duties). Half the industry audits them.

There are some other prospects.

A rebel Financial Market

It has fewer middlemen and can be successful for its consumers.

It is mindful of the fanfare that surrounds these items. They are in the early stages of development due to their cutting-edge nature. There are a plethora of decentralized applications available.

Several specific gaps must be addressed. This idea is similar to traditional credit cards and fiat money. It's getting close to the point where it'll be used.

On the Blockchain, data and techniques are tape-recorded. Everyone on the decentralized network has access to it, and it is encrypted.

To send fiat money to close friends and relatives over the internet. We make use of both traditional banking institutions and exchanges.

These operations might take a long time. And they're pricey to use since they include buying expenses. There are no flaws or drawbacks to DeFi.

This development is similar to standard bank cards as well as fiat money. It's getting closer to the point where it'll be utilized regularly.

The regulators, led by the International Labor Organization (FATF), started. In bringing attention to a significant issue related to cryptocurrencies, they started well with decentralized finance projects, also known as DeFi projects.

Some of the world's most essential crypto companies have joined forces to announce a demand that will further decentralize cryptocurrencies across the globe.

According to this definition, a set of cryptocurrency initiatives aimed at removing intermediaries, providing financial services such as lending, trading, and creating insurance contracts using decentralized automated systems.

Insiders and interested parties also feel that this idea will go beyond the achievements of Bitcoin decentralization.

According to the insider, these efforts will reach the insurance and derivatives trade and savings accounts. "Many DeFi applications are potentially illegal and potentially present a variety of problems for investors and regulators," said Dan Berkowitz, commissioner of the US Commodity Futures Trading Commission.

"There is a lot that is happening too quickly for the authorities to react quickly in practice," said Louis Cohen, partner at Dlx Legal, a cryptocurrency law firm.

DeFi Projects employees welcomed any guidance from financial authorities, although the US Securities and Exchange Commission declined to comment on the process.

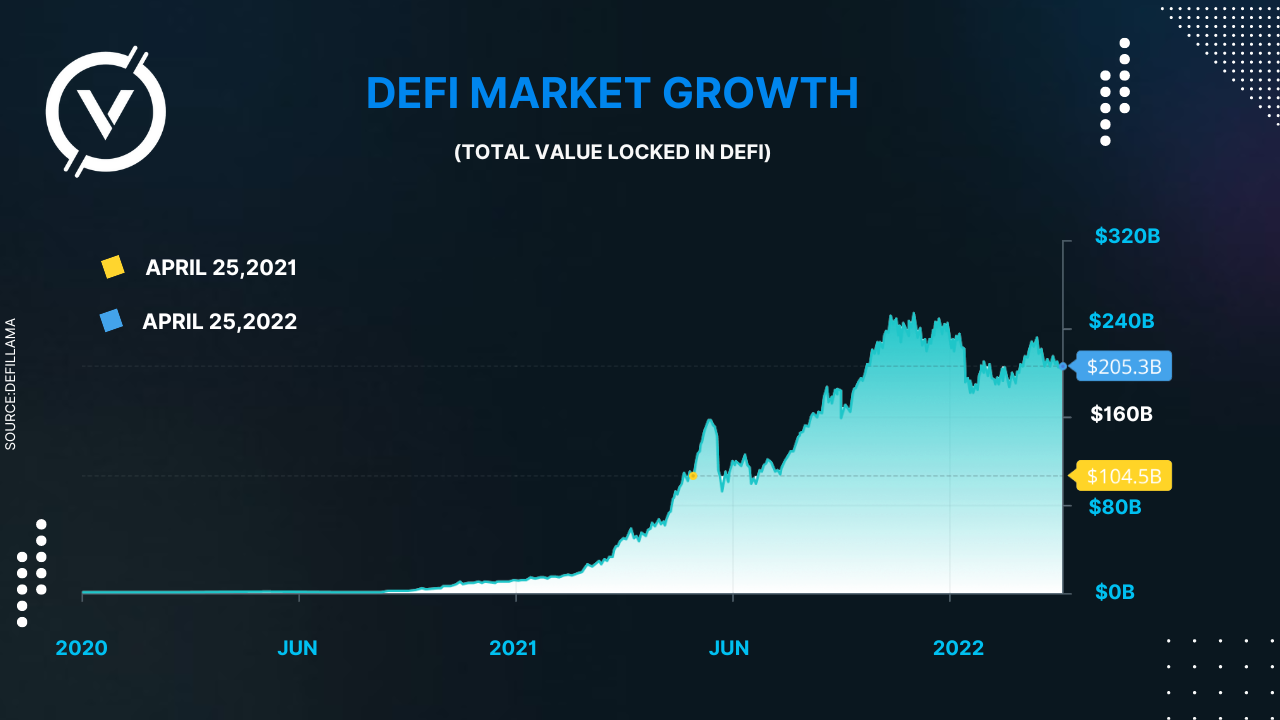

They stated in response that "increased supervision may present an existential risk to our company, as we aspire to build a new financial system." When we find out that the people responsible for these initiatives have established standards for organizing their company, we can determine how seriously they take their business. It is in line with their company's assets which have increased from $2 billion to $50 billion this year.